Wayflyer

Wayflyer helps brands grow faster with flexible, non-dilutive funding designed around your cash flow and sales cycles. Whether you're scaling inventory or acquiring new customers, Wayflyer provides capital when you need it—without giving up equity.

Visit website

What It Is:

Wayflyer is a growth partner that gives you access to working capital in hours - a speed that traditional finance providers simply can't match. Their funding and remittance models are designed for ecommerce brands that need cash to fuel ad spend, inventory, and marketing without waiting 60 days for revenue to come in.

Role In Your Lifecycle Ecosystem

Invest in Lifecycle Marketing

Use capital to build long-term revenue instead of short-term sales.

- Scale your email and SMS programs with better creative, tools, or support.

- Invest in retention tools that improve LTV.

- Test, optimize, and improve backend conversion infrastructure.

Scale Inventory & Fulfillment

Avoid stockouts and prepare for spikes in demand.

- Fund inventory purchases ahead of big campaigns or promotional periods like Black Friday/Cyber Week.

- Smooth out operations across supplier delays or payment cycles.

- Maintain stock and decrease fulfillment times.

Accelerate Customer Acquisition

Add more fuel to what’s already working.

- Unlock cash to reinvest in your highest-performing paid channels.

- Scale your ad spend without waiting for delayed ROAS.

- Bridge the gap between CAC and your payback period.

Expand Product Catalog

Support product development and testing through better cash flow.

- Use funding to launch new SKUs or product lines.

- Avoid delays in R&D or sourcing due to cash constraints.

- Grow AOV and LTV by diversifying your catalog faster.

Fit:

Goals:

Goals It Supports:

- Sustainable and aggressive growth.

- Smarter use of capital across acquisition and retention.

- Bridging cash flow gaps without taking on long-term debt.

Built For:

Best Fit For:

- Brands with solid product-market fit and clear growth potential.

- Operators who understand their CAC:LTV model and want to scale.

- Teams looking to reinvest in paid, lifecycle, or inventory.

Must-Haves:

Must-Haves:

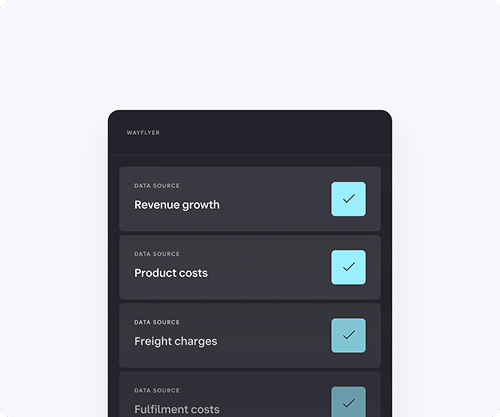

- Ecommerce platform or marketplace with connected data.

- Monthly revenue consistency and minimum revenue thresholds.

- Proven acquisition and/or retention strategy with upside potential.

Ways To Use It:

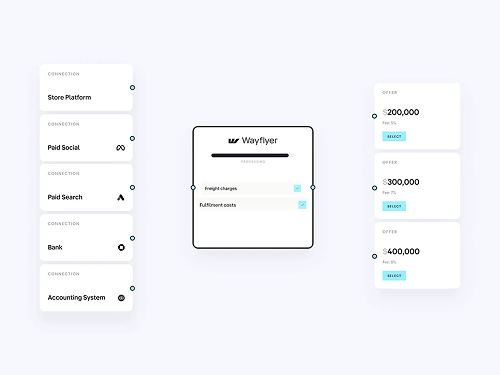

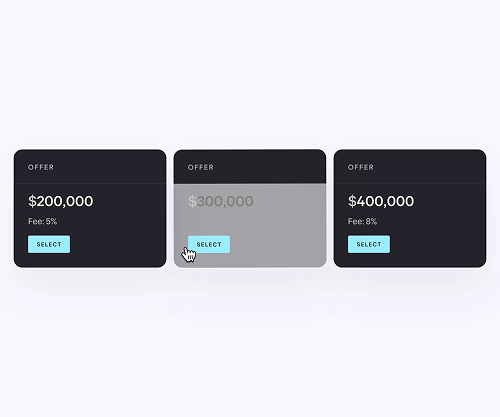

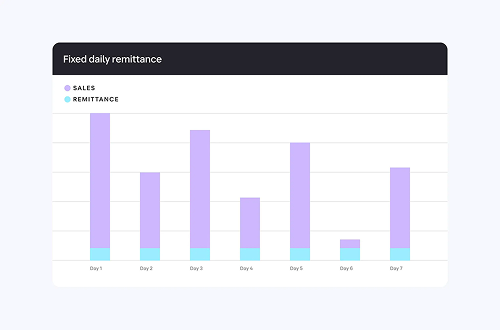

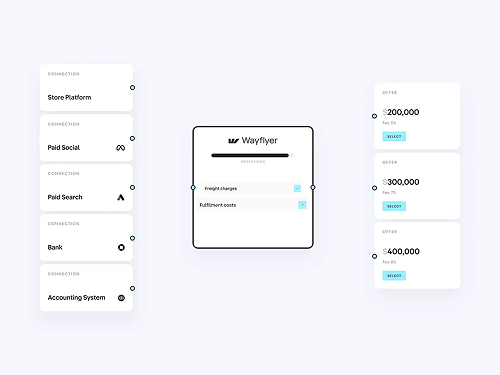

Here's how Wayflyer works

Wayflyer is best used as a growth multiplier and not as a fix for bad fundamentals. Here’s how to use it strategically:

-

Identify where capital could have the biggest impact: underperforming but profitable ad channels, inventory constraints, new product development, or retention gaps.

-

Plan out how much funding you need and what you’ll use it for. Be clear on expected ROI, CAC:LTV ratio improvements, and payback timelines.

-

Break up capital by short-term ROI (e.g. ads or inventory restock) vs. long-term compounding bets (e.g. subscriptions, retention systems, new SKUs).

-

Use funds to secure better COGS through bulk orders, improve retention, or test higher-margin SKUs to increase profitability over time.

-

Track outcomes tied directly to each use of capital. Adjust future deployment based on what yields the best revenue velocity and profit lift.

-

Roll capital returns into the next highest-leverage opportunity. Compound small wins into bigger ones by constantly reinvesting in what works.

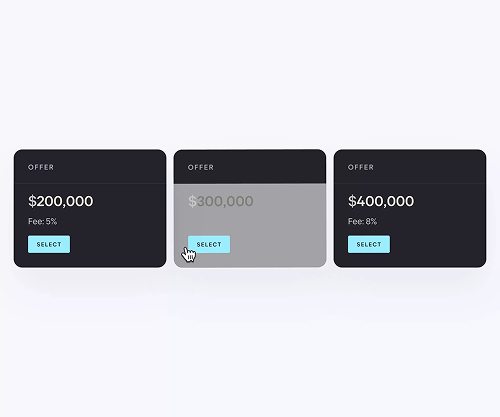

Image Gallery: